Commercial Real Estate Asset Management Strategies

Effective asset management is a crucial element of successful CRE investing. The broad role of commercial real estate asset management is to maximize returns and mitigate risk. However, much goes into those dual roles. Asset managers may also pursue various strategies to limit risk or increase returns. This post will cover common CRE asset management strategies you should know.

Strategies for Commercial Real Estate Asset Management

Portfolio Diversification

Many CRE investors start by focusing on one type of commercial real estate. With diversification, you move to spread your investments across multiple categories. For example, you might begin with multi-family and then move into office, hospitality, or retail real estate. This strategy helps balance risk and stabilize income, as different property types often perform differently under varying market conditions.

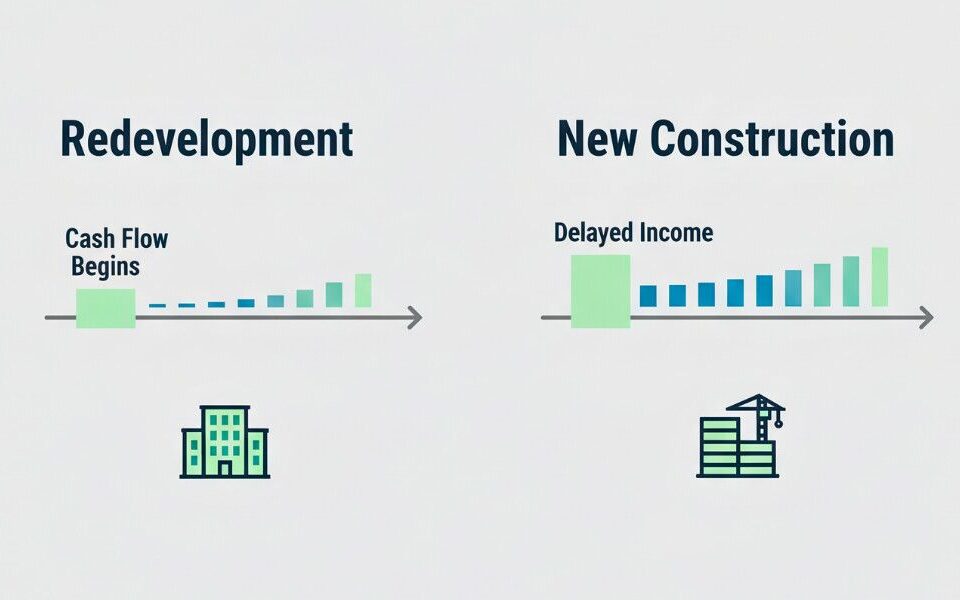

Value-Add Strategies

Value-add strategies focus on enhancing the value of commercial real estate properties through improvements and repositioning. It can include renovating outdated facilities, upgrading amenities, or converting the property’s use to meet current market conditions. The idea is to increase the property’s appeal to potential tenants and deliver enhancements that allow for higher rental rates. Along with boosting income, value-add strategies can increase the asset’s market value.

Geographic Expansion

Just as with property types, most investors start by focusing on one geographic region. However, there may be a time when it is advantageous to move into new markets. Geographic expansion spreads assets into new locations. Expanding into new regions can reduce exposure to local market risks and economic fluctuations. Geographic diversification ensures a more stable and resilient portfolio since performance is not dependent on a single market.

Operational Efficiency

Some investors choose to target underperforming properties with plans to improve operations. This strategy focuses on optimizing property management practices, reducing operating costs, and implementing sustainability initiatives. Investors can transform poorly performing properties into high-yield assets by streamlining operations, addressing inefficiencies, and improving property management. This strategy not only increases profits but it can also make the asset more valuable.

Increasing Revenue

Various CRE strategies may involve taking existing assets or acquiring new ones and developing plans to increase revenue. Common elements of these strategies include financial management, lease optimization, and property improvements. Regular financial reporting and analysis can assist with optimizing budgets. Capital improvements like renovations can boost property value and attract higher-paying tenants. Lease optimization, through renegotiation and competitive rental rates, ensures income stability.

Commercial real estate asset management is complex, and different strategies will appeal to different investors. However, a good asset manager can help analyze your portfolio, goals, and resources to develop a suitable strategy.

Are you interested in Lake Havasu commercial real estate investments? Click here to contact Randy Shuffler for expert guidance. Whether retail, office, multi-family, industrial, or anything else, we can help. Reach out to learn more about our commercial real estate services in Lake Havasu City.

Thanks for visiting!