The Power of Early Land Banking

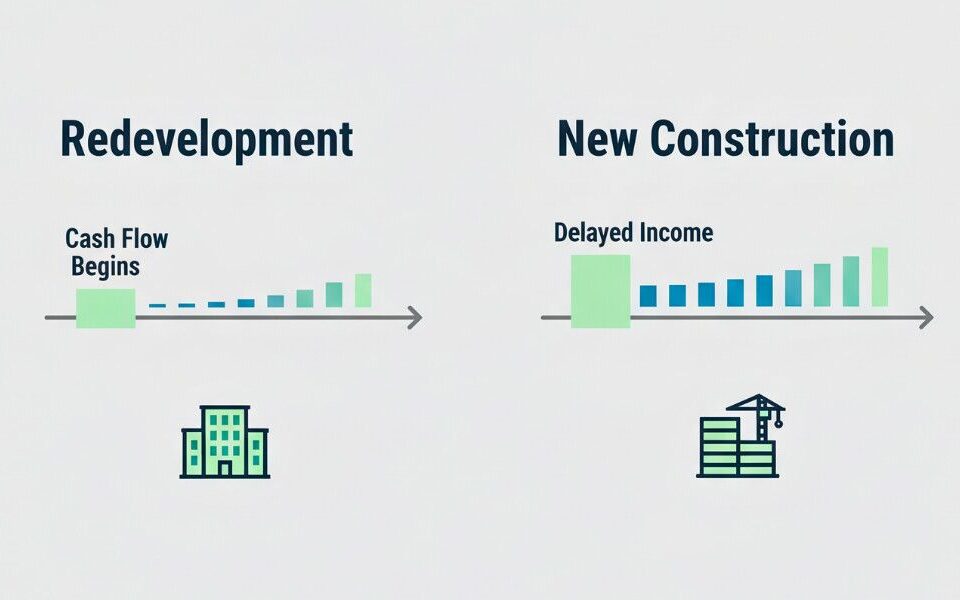

Most commercial real estate investors want a defined timeline for when they’ll start seeing a return. Most investors want properties that provide revenue immediately. While a quick turnaround or immediate revenue is attractive, there’s a significant upside in strategies with longer horizons. One such strategy is early land banking. This post explores the basics of land banking and what makes it attractive.

The Advantages of Early Land Banking

Land banking is a long-term investment strategy involving purchasing and holding undeveloped land. An investor purchases the land at a relatively low cost and waits for the value to increase. Once the value reaches a target or a specific event occurs, the investor sells or develops the land. Common strategies include buying land on the urban fringe, along transit corridors, or in markets with forecasted growth.

Capitalize on Appreciation Potential

One of the biggest advantages of land banking is the potential for significant appreciation over time. Growth factors can include population increases, urban sprawl, or nearby development. An upcoming infrastructure project could influence property values. When timed correctly, land banking allows investors to capitalize on these trends and realize substantial returns.

Land as an Inflation Hedge and Diversification

A significant key to real estate investing is that land is a finite, physical asset. Land can be a powerful inflation hedge. What makes it even better is that strategic real estate investments can appreciate faster than inflation. That means you’re growing wealth rather than just preserving it. Land is less volatile than many traditional investments, offering stability during economic uncertainty. Holding real estate is a smart diversification strategy against other investment types.

Low Maintenance and Holding Costs

Another key benefit of undeveloped land is that it is easier to manage and has lower overhead costs. An income property will have tenants, regular upkeep, and repair needs. With no buildings or tenants, you don’t need to worry about these burdens or costs. Property taxes are also generally lower on raw land than on developed sites. You also don’t have any buildings or occupants to insure. That means less effort and a lower ongoing financial burden for the property owner.

Flexible Use and Income Strategies

Investors may like land banking for its flexibility. You have many options for profiting from or using the land. For some investors, it might be as simple as holding the land until it reaches a specific value. Developers might buy land early and then hold until market conditions are right to build. Investors might subdivide, rezone, or partner with developers depending on local demand and infrastructure growth. The range of possibilities means land banking can work for different investors.

Land banking can be a lucrative investment strategy, but there are risks. It is a long-term strategy, so you must be prepared to hold the land for some time. While land typically appreciates, markets can fluctuate. Consulting local real estate professionals can help you identify opportunities and navigate the market.

Are you interested in investing in commercial real estate in the Lake Havasu area? Whether it’s raw land or developed, Shuffler Commercial Realty can help. We know the local market and can help you succeed. Reach out to learn more about CRE investing in Lake Havasu.