Full Occupancy Can Hide Risk in Lake Havasu CRE

On paper, full occupancy can look stable and attractive to investors. But it isn’t always a safe bet.

In Lake Havasu today, the deals that look cleanest on paper can be the riskiest. They show 100% occupancy, strong in-place rents, and a past-year financial record that’s neat and impressive.

The issue isn’t occupancy. It’s income durability.

Buying cash flow that can’t survive the first lease rollover doesn’t buy stability. It buys timing risk.

Full Occupancy Doesn’t Guarantee Safety

For years, the market rewarded this assumption. Investors treated fully leased buildings as low risk.

That worked when rents climbed fast, tenants had few alternatives, and refinancing could erase mistakes. Buyers assumed that even if something went wrong, the market would step in.

Those conditions aren’t guaranteed anymore. Today, a fully leased property at peak rents can be more fragile than a partially vacant one. The risk just hides better.

A clean rent roll does not equal protected income.

Why Over-Leased Buildings Happen

Over-leasing rarely happens by accident. It usually comes from pressure.

In Lake Havasu, we see three standard drivers:

- COVID-era rent spikes outpaced business fundamentals. Many tenants, especially local operators without pricing power, faced rents rising faster than their revenue.

- Short-term lease-ups the owner did to prep for sale. Space fills quickly at aggressive numbers to create a strong trailing twelve, even if the lease terms are short.

- Tenants stretch to secure space. They sign leases that work today but leave no margin when costs rise or sales slow.

On paper, the NOI looks excellent. In reality, you may inherit tenants already questioning whether the rent still works.

The First Rollover Breaks Deals

First-time and out-of-area buyers often get hurt at the first lease rollover.

Common mistakes include:

- Underwriting in-place rent as permanent

- Treating vacancies as future problems

- Assuming renewals are a given

When even one tenant leaves, and replacement rents reset lower, actual net income can drop fast. Sometimes this is enough to break lender covenants or trigger capital calls.

That’s how a seven-cap quietly becomes a five after the first rollover. There was no headline change or market crash. Just math catching up.

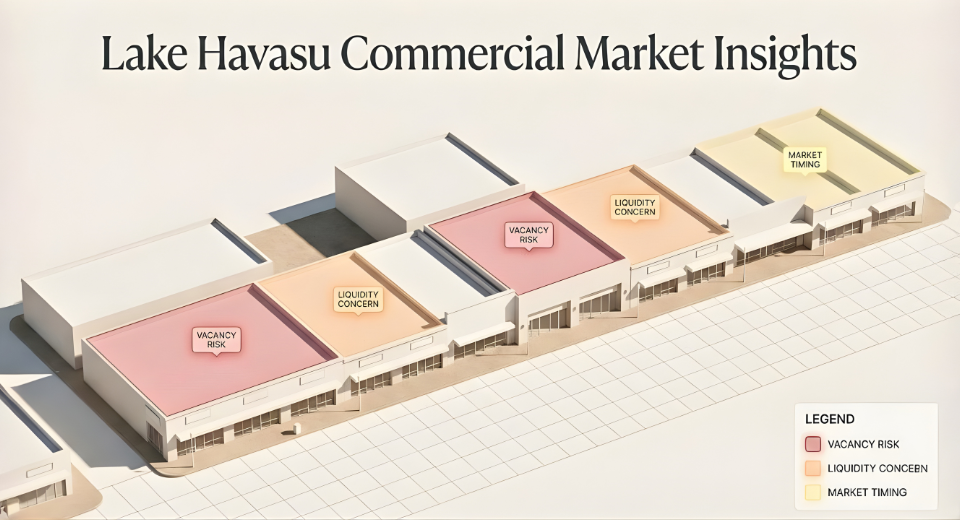

How Lake Havasu Amplifies the Risk

Lake Havasu faces real constraints. Land remains scarce, and developers struggle to create new supply. These factors support pricing over time.

But scarcity doesn’t guarantee tenant profitability. At a certain point, businesses can’t pass rent increases along. Rising housing costs hurt employee retention, and operators may downsize, relocate, or quietly close.

When that happens, over-leased buildings correct through vacancy, not price cuts.

On the ground, tenants are more cost-aware. Renewals take longer, concessions appear in marketing packages, and listed rents don’t always match defendable rents.

Downside risk in Lake Havasu shows up operationally before it shows up in pricing.

The Danger of “Perfect” Deals

Over-leased buildings are dangerous because they look boring.

You don’t see deferred maintenance, and the property is full.

Everything feels solved, which often makes buyers stop asking hard questions. When nothing looks broken, people assume nothing can break.

That assumption is usually wrong.

The less obvious the risk, the more disciplined your underwriting must be.

How We Underwrite Fully Leased Buildings Differently

When a deal is fully leased, we ask more complex questions:

- Are rents above market, or just last year’s comps?

- How long are the leases, really?

- What if the weakest tenant leaves first?

- Does the deal pencil at reset rents, not today’s?

If the numbers only work assuming no one ever leaves, the deal does not work. That’s how you protect the downside.

We aren’t being pessimistic. It’s about operating in today’s reality. Tenants turn over. Markets breathe. Income needs room to flex.

Underwriting should assume friction, not perfection.

A Real-Life Example of Over-Leasing Risk

A buyer once told us they loved a deal because it had zero vacancy and “no management headaches.” Rents were top of market, leases were short, and the price assumed complete renewal.

Eighteen months later, the smallest tenant left. Replacement rent came in 15% below expectations. That triggered a review by the lender. It wasn’t because the building was bad, but because the income was thinner than advertised.

Nothing dramatic happened. Just one tenant making a rational business decision.

The buyer still owns the building. It still works. But the margin they thought they bought was never real.

That’s the hidden risk. Over-leasing doesn’t blow up loudly. It erodes quietly. Most losses come from assumptions, not disasters.

The Buildings We Prefer in Today’s Market

We prefer buildings with honest rents, even if they have a single vacancy. Fully leased properties priced on income that owners cannot defend are riskier.

Vacancy is visible. Over-leasing hides risk until it hits.

A vacancy lets us reset correctly. Over-leasing forces us to absorb corrections under pressure.

When capital is on the line, transparency always beats appearance.

Buyer FAQs on Over-Leased Buildings

Is full occupancy ever a good thing?

Yes, when market demand supports rents and tenants remain profitable. Occupancy becomes risky when it relies on tenants stretching or short-term leases at peak pricing.

How do I tell if rents are defendable?

Compare in-place rents to current asking rents, not last year’s deals. Then look at tenant health. If renewals require concessions, the rent is not as strong as it looks.

Does this risk apply only to small buildings?

No. Larger properties can hide this risk even more effectively because the income appears diversified. One weak segment can still drag performance down.

What lease length is safest right now?

There is no perfect answer. Longer leases protect near-term income but can lock in over-market rents that tenants push back on later. Shorter leases give flexibility but require capital discipline.

Can firm reserves offset over-leasing risk?

Reserves help with timing, not valuation. If rents reset lower, reserves do not fix the income story.

Should I avoid fully leased buildings altogether?

No. You should avoid deals where the math only works if nothing changes. Fully leased buildings need more scrutiny, not automatic discounts.

What is the first number I should stress-test?

Actual net income after one tenant leaves. If the deal does not pencil there, it is fragile.

Test the True Value of Fully Leased Deals

In Lake Havasu, full occupancy can mask risk. The key is knowing whether income is real or just well-presented.

At Shuffler Commercial Realty, we make it easy to pressure-test fully leased properties. Send us the address for a quick, no-pressure reality check. We’ll show how the numbers perform after the first rollover.

Connect with my team today and get a clear picture of your property’s true earning potential.