Lake Havasu CRE Deals Are Won or Lost in Underwriting

Money did not leave Lake Havasu. Easy underwriting did. Banks are still lending, and private capital remains active. What changed is tolerance for weak assumptions.

Since 2022, underwriting has become more disciplined, more selective, and far less forgiving of projected upside. That shift is not stopping deals at the offer stage. It is quietly killing them deeper in the process, inside credit committees, where optimism meets math.

This distinction matters because pricing alone no longer decides outcomes. Income quality does. Deals now succeed or fail based on the durability of cash flow, not the headline number on the contract.

Price Alone Doesn’t Close Deals

For years, the rule was simple. If the price felt reasonable, the deal would close. Lenders showed flexibility, accepted rent growth assumptions, and explained away minor weaknesses.

That playbook no longer works.

Today, fair-pricing deals are collapsing late in escrow. Not because sellers are overreaching, but because the risk profile fails under stress testing. Pricing is no longer the finish line. Underwriting is.

A deal can look correct on paper and still be dead on arrival if the income does not withstand lender scrutiny.

The Underwriting Shift Since 2022

Banks did not disappear. They recalibrated.

Here’s what lenders are doing now in this market:

- They stress-test income more aggressively.

- They discount pro forma rent growth.

- They require stronger debt coverage.

- They scrutinize tenant durability.

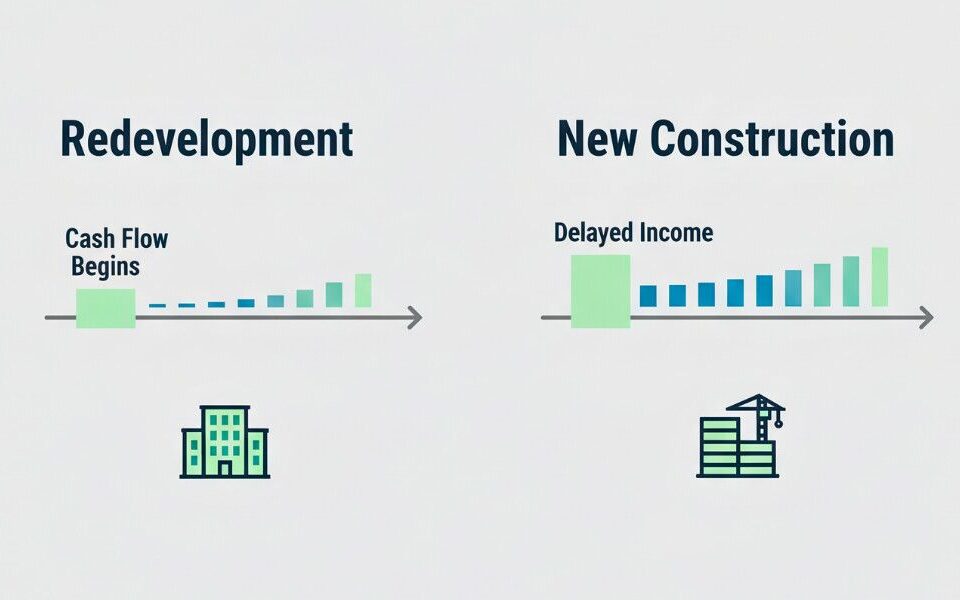

Deals that rely on new businesses, SBA-heavy assumptions, or aggressive rent increases face a much higher bar. By contrast, properties with existing, durable net income move through underwriting more smoothly, even at lower leverage.

Inventory remains tight in Lake Havasu, and lenders know it. That makes them cautious, not absent. The cleaner and more seasoned the income, the smoother the path to closing, even at lower leverage.

Where Deals Quietly Fail

Most failed transactions do not blow up at the letter of intent stage. They die quietly in underwriting.

Common failure points include:

- Net operating income that does not survive vacancy stress.

- Rents that look inflated versus the current market reality.

- Expense assumptions that do not hold.

- Tenant rollover risk that is not priced correctly.

I often see buyers agree on a price that seems fair. Then they discover the bank won’t approve the deal without a numbers reset. Lenders aren’t being difficult. The market is enforcing discipline.

If a deal relies on best-case assumptions to work, underwriting will expose it.

Why New Buyers Struggle

First-time and out-of-area buyers often get caught off guard. They chase cap rates, comparable sales, and persuasive seller stories. Banks are looking at something different: cash flow durability, downside protection, and what happens if a key tenant leaves.

That disconnect is where deals fail. Assets that appear cheap on the surface can be effectively unfinanceable without significant equity. Price alone does not equal value when capital cannot support it.

In today’s market, understanding lender logic is just as important as finding the deal itself. Success depends on seeing the transaction through the bank’s lens, not only your own.

Determining What a Deal is Really Worth

When capital is selective, we start with one question: Does the income survive reality?

Next, we strip out inflated rents and normalize expenses. We stress-test vacancy and tenant rollover. Then we calculate the cap rate actually earned, not the advertised one. If a deal only works under perfect execution, it doesn’t work at all.

This method protects the downside. It also explains why buyers who understand underwriting can move quickly, while others chase deals that never close.

Seller Expectations vs. Market Reality

Sellers are not wrong to expect strong pricing. Inventory remains tight, and demand persists. But pricing based on 2021 underwriting assumptions invites friction.

When sellers stretch the numbers, buyers lose leverage with lenders, timelines lengthen, and deals stall. Presenting realistic income closes more transactions than relying on aggressive projections.

Clean math shortens escrow more effectively than optimism.

Buyer Challenges in Lake Havasu

For buyers, it isn’t about finding creative financing. You need to structure deals that capital can approve.

Selective capital favors realism. They’re looking for deals that protect the downside, account for rollover risk, and demonstrate durable income. The rest linger or fail quietly.

Common Investor Questions About Underwriting in Lake Havasu

Is capital still available for commercial real estate in Lake Havasu?

Yes. Local and regional banks, along with private lenders, are still active. What has changed is how selective they are about the deals they’ll approve.

Why are deals falling apart late in escrow instead of at the offer stage?

Because underwriting is where assumptions get tested. Agreeing on a price is often easy. The deal fails when lenders stress-test income, vacancy, expenses, and tenant risk. These issues often surface only after a detailed review of the financials.

What income characteristics do lenders favor right now?

Lenders prefer stable tenants with an operating history and staying power. Properties with diversified tenant bases, longer lease terms, and realistic rent levels generally move through underwriting more smoothly.

Are pro forma rent increases still financeable?

Only to a limited extent. Most lenders now heavily discount projected rent growth unless it is already underway or clearly supported by executed leases. Deals that rely on future rent increases to make the numbers work face tighter scrutiny.

How should buyers adjust their underwriting today?

Assume more conservative rents, normalize expenses, stress-test vacancy, and model what happens if a tenant leaves. If the deal still works under those conditions, it is much more likely to close.

Make Every Deal Count

Lake Havasu did not lose its lenders. What changed is their tolerance for sloppy math. The deals that close today respect underwriting, acknowledge constraints, and recognize how sellers manage downside risk.

For clarity on your next deal, contact Shuffler Commercial Realty. Start your conversation today and ensure your underwriting matches what the market will finance.