How Lake Havasu Land Scarcity Impacts CRE Investors

If your underwriting assumes new commercial real estate supply will appear quickly, the numbers are already off. Deals don’t just materialize in this market. Land is finite, and development timelines are long.

The risks accumulate if you underestimate these constraints. For investors who respect these realities, the opportunities are real. Ignoring them can undermine even the most promising plans.

Land Scarcity Is Structural, Not Cyclical

Outsiders often look at a map and assume expansion is inevitable. It appears open, undeveloped, and like time will fill in the gaps. On the ground, the reality looks very different.

Federal land, state land, and the lake box in Lake Havasu. The parcels that remain inside city limits offer limited opportunities, and much of the available land isn’t easy to develop. That distinction matters here more than in most markets.

You can’t underwrite Lake Havasu like a market with outward sprawl and inexpensive land.

The Myth of “Unused” Land

Parcels exist on paper, but many come with severe constraints: washes, floodplains, steep slopes, or all three. Add the cost of fill, grading, and retaining walls, and land value rises fast. The city’s development code can pose challenges for some projects.

Next come engineers, utilities, and entitlements. These are not theoretical obstacles. They require time and money. There are also real risks involved.

Ground-up commercial projects here often take 1-5 years from acquisition to stabilized income. That is not a permitting failure. It is the reality of investing in Lake Havasu land. Time-to-income is not a footnote. It’s the primary risk variable for any investor.

Why Replacement Cost Keeps Rising

As the easiest parcels get absorbed, the remaining land costs more and takes longer to develop. Labor isn’t getting cheaper, and material costs show no signs of sustained decline. Infrastructure work adds yet another layer of cost and complexity.

Replacement costs rise even when headline pricing appears flat. That is why existing, well-located properties tend to retain their value. Long-term supply cannot expand beyond its limits, and you cannot simply build your way out of demand.

Scarcity supports value, but only if you avoid overpaying for hypothetical upside.

How Land Constraints Impact Returns

Scarcity works both ways. On the upside, long-term supply cannot expand, replacement costs rise, and existing income gains value over time.

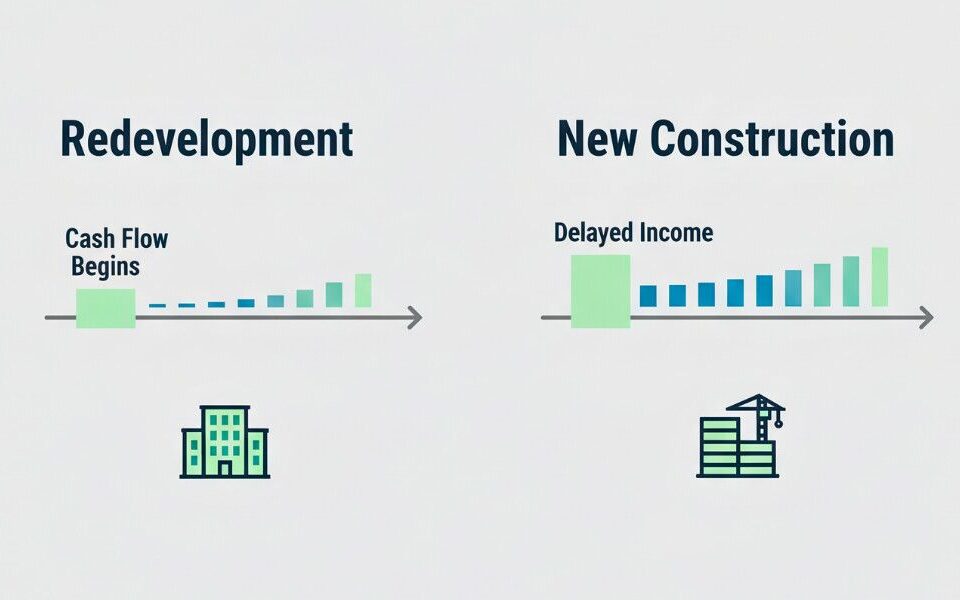

On the downside, new construction often struggles once you account for real timelines, carrying costs, and actual net income. A shiny new build that looks like a 6% return on paper often underwrites closer to 3% or 4% in reality.

In contrast, redevelopment and infill projects can return 7–8% because income arrives sooner and uncertainty is lower. Investors capture value in a constrained market by focusing on deals that actively reduce time risk. The highest returns come from lowering time risk rather than chasing theoretical rents.

A Short Story From the Field

A buyer recently toured a site that looked perfect on paper: clean parcel, good visibility, and a reasonable price. The plan assumed twelve months to income.

Once work began, the timeline stretched. Engineering flagged drainage issues tied to a wash. Grading costs rose. Utility coordination took longer than expected, and carrying costs accumulated.

Nothing went wrong. No one mismanaged the project. The land simply behaved as Lake Havasu land often does. By the time the project stabilized, the return had dropped to half the original model’s projection. Meanwhile, a nearby infill property with existing tenants continued generating steady actual net income.

Edge cases are rare. Lake Havasu punishes optimistic timelines more than almost any other market.

Why Sellers Ask So Much

Long-time local owners understand land scarcity firsthand. They’ve watched the available inventory of developable land disappear. Locals have also seen costs climb and development become more complex year after year.

That’s why sellers anchor to prices that may feel aggressive to outsiders. The gap is not emotional. It’s informational. Buyers see the number. Sellers see the constraints behind it.

If a price seems high, consider whether you’re undervaluing the impact of land scarcity.

How to Win in This Market

Lake Havasu does not reward speed for its own sake. It rewards patience grounded in realism.

When buying here, respect land constraints, account for long timelines, and prioritize existing income. Question “easy” development stories and protect the downside first.

Scarcity supports long-term value, but only when assumptions stay realistic.

Common Investor Questions Answered

Is Lake Havasu actually running out of land for commercial development?

Yes, in practical terms. While parcels exist on paper, topography, washes, and entitlement hurdles limit many of them. Developable land that pencils cleanly is increasingly scarce.

Does land scarcity automatically mean prices will keep rising?

Not automatically. Scarcity supports value, but pricing still has to make sense relative to actual net income. Overpaying for theoretical upside can erase the benefit.

Why do new construction deals struggle here?

Long timelines, high carry costs, and rising replacement costs compress returns. Time-to-income is often the most significant risk.

Are infill and redevelopment better strategies in Lake Havasu?

Often, yes. Existing income reduces uncertainty and can yield more accurate net returns than ground-up projects.

How should buyers underwrite land deals differently here?

Discount timelines aggressively, assume higher costs, and stress test carry periods. If the deal only works with perfect execution, it likely does not pencil.

Do out-of-market buyers face additional risk?

They can, especially if they underestimate local constraints. Understanding what does and does not work on the ground is critical.

Leverage Scarcity for Maximum Returns

In Lake Havasu, scarcity creates value, but only when assumptions are accurate. Bad assumptions and limited land erode returns.

Want to see how a specific property performs when we factor in actual net income and realistic timelines? Contact my team today to make data-driven decisions that protect your downside and maximize long-term value.