Sellers Price Yesterday. Buyers Underwrite Today in Lake Havasu

In Lake Havasu commercial real estate, the clash isn’t about interest rates. It’s about which year still matters. Sellers reference 2021 and 2022 comps, while buyers underwrite today’s realities. That disconnect, not inventory or financing, slows deals.

Those COVID-era sales happened. Prices closed and checks cleared, but underwriting has moved on. Capital has shifted, and the market has actively repriced risk.

A property must demonstrate it has sustainable income. When sellers anchor to outdated comps rather than current market math, listings stall, and leverage quietly erodes.

Why Old Comps Don’t Set Today’s Price

The last comp shows where the market was, not where buyers are underwriting today. Debt costs more, and exit assumptions are tighter. Buyers aren’t paying for hope or momentum. They are paying for income that can withstand a reset.

Relying on historical comps without adjusting for current underwriting leads to longer time on market and weaker deal terms.

What Buyers Are Doing Differently

Here’s what active underwriting looks like today:

- Cap rates drift toward 7 to 8 percent for most commercial assets.

- Underwriters discount or remove rent growth assumptions.

- Investors normalize expenses at higher levels than sellers expect.

- They also price in tenant rollover risk rather than ignore it.

Values aren’t collapsing, but expectations have reset. Deals that adjust go through, while those anchored to the past sit. Buyers still transact, but only when the numbers protect against downside risk.

Buyers Aren’t Just Being Conservative

Today’s buyers are being realistic. Cheap debt no longer masks mistakes. Underwriting now has to work with actual net income, not pro forma optimism. Vacancy matters, lease terms matter, and duration matters.

Conservative underwriting has become the baseline, not a temporary negotiating stance.

Why Overpricing Always Backfires

When pricing stays anchored to yesterday, three things happen fast:

- Buyer traffic drops

- The buyer pool shrinks

- Time on market quietly erodes leverage

Sellers often assume they can test a number and adjust later. The market remembers the test, and by the time the price moves, leverage has already leaked out. Early adjustments preserve negotiating strength far more than late-stage reductions.

Peak Rent Assumptions Can Kill Deals

One of the biggest disconnects today is treating peak rents as permanent. Many assets are fully leased at top-of-market rates, leaving little room for error if conditions soften.

Some properties are one lost tenant away from being on shaky ground. Others face lease rollovers that reset at lower numbers. Buyers taking on that income inherit the risk immediately.

If underwriters can’t price the risk, the deal doesn’t pencil. Peak income without duration does not create durable value.

What Buyers Actually Pay For

Buyers still pay premiums, but only when scarcity justifies it. Location constraints, replacement cost realities, and long-term tenants with strong credit support those premiums. They are underwritten, not assumed.

Leftover optimism doesn’t get paid for. Justified scarcity wins, while unproven upside does not.

A Real Deal from the Ground

Last quarter, we handled a deal where the seller pegged the property to a 2022 sale. On paper, it seemed close, but income was thinner, expenses understated, and two leases rolled over within 18 months.

The first round of buyers passed, and the seller waited. Days stacked up.

Eventually, the seller agreed to review an accurate net snapshot. Once underwriters normalized expenses and priced in rollover risk, the value gap became clear. The seller adjusted pricing before the listing went stale.

Buyer traffic returned. The deal closed without panic, retrades, or regret.

This outcome wasn’t about winning an argument. It was about aligning timeframes.

The seller stopped underwriting yesterday, and the buyer stopped assuming hidden traps. Both sides protected the downside.

Bridging the Pricing Gap

The market doesn’t need cheerleaders. It needs translators.

Our team guides sellers through what buyers are actually underwriting today. We show how underwriters adjust actual net income and explain why holding out for yesterday’s pricing costs more than repricing early.

We help buyers distinguish between absolute scarcity and leftover optimism. Some premiums justify payment. Others do not.

That is how deals close without forced urgency or missed risk. Alignment beats pressure every time.

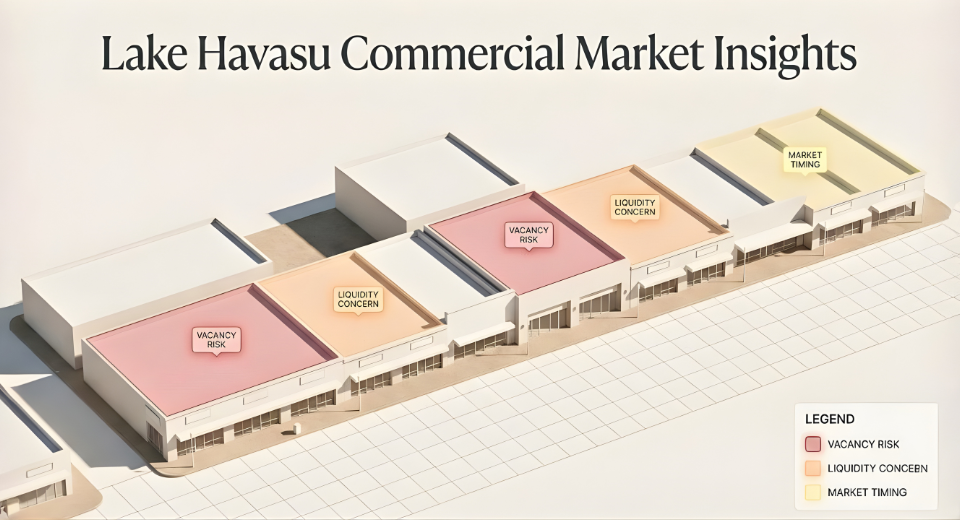

Where Lake Havasu Really Stands

Lake Havasu is not broken. It is rebalancing. Inventory remains tight, land is in short supply, and demand stays strong. The pricing conversation has simply moved forward.

Sellers who price for today see deals move; those who do not wait longer than expected.

Momentum favors pricing realism.

Pricing, Risk, and Underwriting FAQs

Why are cap rates higher now?

Cap rates expanded as debt costs increased and risk premiums returned. Buyers need higher yields to justify the uncertainty. The market is not collapsing. It’s returning to underwriting discipline.

Should sellers wait for rates to drop?

Waiting assumes everything else stays static. It rarely does. Income, expenses, and tenant behavior shift over time. Pricing today often beats betting on tomorrow.

Are fully leased properties safer?

Not always. High occupancy at peak rents can mask near-term lease rollovers. Buyers quickly adjust for that risk.

Is repricing a sign of weakness?

No. It signals engagement with reality. Buyers respect sellers who adjust early more than those who defend stale numbers.

Price Smart. Protect Your Profits.

In Lake Havasu’s commercial real estate market, deals move fastest when sellers and buyers align. Anchoring to outdated comps slows transactions and erodes leverage.

At Shuffler Commercial Realty, we provide true-net snapshots and underwriting guidance so your numbers reflect today’s market. Reach out to my team to see what buyers are underwriting and how your property measures up.