Where to Find the Best Lake Havasu Commercial Real Estate Cap Rates in 2025

Looking for the best commercial real estate cap rates in Arizona this year? Lake Havasu is shaping up to be one of 2025’s most investor-friendly markets. Known for its small-town appeal, booming tourism, and expanding local economy, Lake Havasu offers a rare mix of growth potential and affordability.

Cap rates in Lake Havasu commercial real estate are holding strong, especially across industrial, retail, and multi-tenant properties. But to find the highest returns, you need more than a listing search—you need a smart strategy and local insight.

In this guide, we’ll break down where to find the best Lake Havasu commercial real estate cap rates in 2025. We’ll also cover what types of properties are producing the strongest ROI, and how to make your next move count.

Looking for properties right now? View current listings!

Where Lake Havasu’s Commercial Market Stands in 2025

Lake Havasu’s CRE market continues to benefit from steady population growth, thriving tourism, and a wave of incoming small businesses. While larger Arizona metros are experiencing price plateaus, Lake Havasu remains a value play. The area has lower acquisition costs and cap rates averaging 6.5% to 8.5%, depending on asset class.

The city’s pro-business environment and strategic location make it particularly attractive to out-of-state investors looking to diversify.

What Types of Commercial Properties Offer the Best Cap Rates?

Certain asset types are consistently outperforming in terms of return on investment:

- Industrial/Warehouse: Driven by e-commerce, trades, and small-scale manufacturing. These properties often deliver cap rates on the higher end of the range.

- Multi-Tenant Retail Centers: Especially those anchored by service businesses or medical tenants. Strong foot traffic and flexible leasing arrangements make these properties investor favorites.

- Standalone Medical or Professional Offices: Long-term leases with stable tenants offer consistent cash flow with limited turnover.

- Value-Add Opportunities: Older buildings in emerging corridors can be repositioned for stronger returns if you know what to look for.

Each of these property types comes with a risk-reward profile. The key is understanding the neighborhood, tenant base, and long-term demand.

Top Areas in Lake Havasu for Strong Returns

If you’re searching for the best cap rates in Lake Havasu commercial real estate, location is everything. Here are four areas to watch:

- Downtown Lake Havasu: A mix of walkable retail and small office spaces. Popular with both locals and tourists.

- Industrial Park District: Growing demand from logistics and trade service companies makes this a high-return zone for warehouses and flex spaces.

- McCulloch Blvd Corridor: A steady hub for retail, medical, and professional service tenants.

- North End Growth Zones: With new residential development underway, this area is a prime spot for retail or mixed-use expansion.

Curious about what’s available in each of these areas? Contact Randy for a location-specific ROI report.

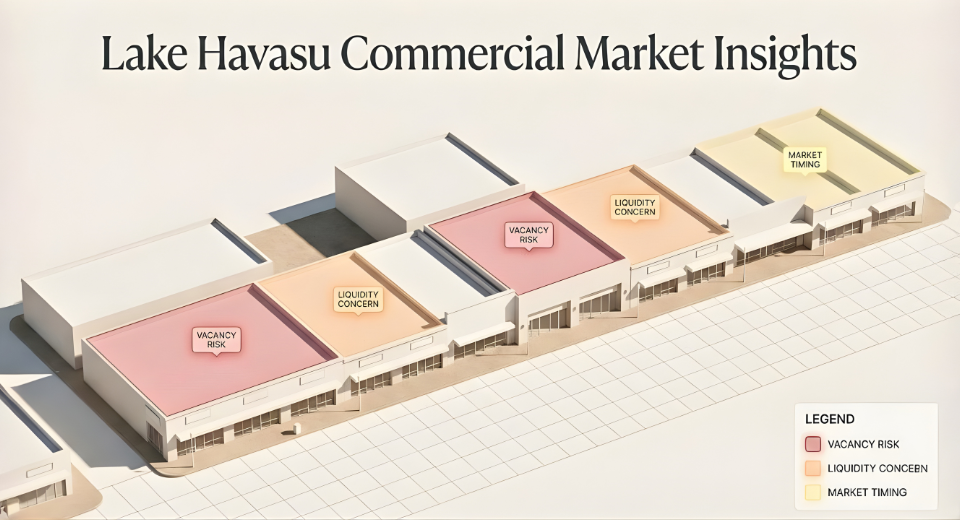

Factors Impacting Lake Havasu Commercial Real Estate Cap Rates in 2025

Several local market dynamics influence whether a cap rate is truly “good” or not:

- Vacancy Rates & Tenant Stability

- Lease Lengths & Renewal Terms

- Zoning & Future Development Potential

- Condition & Age of the Building

- Investor Demand & Market Inventory

Understanding these variables is critical when comparing two similar properties with different cap rates. A higher cap rate might look good on paper, but not all income streams are created equal.

How to Find High Cap Rate Deals Without Overpaying

Here’s the truth: great cap rate opportunities rarely sit long on the open market. Here’s how serious investors are winning in 2025:

- Go Off-Market: Work with a local broker (like Randy) who has relationships with owners not yet ready to list publicly.

- Target Value-Add Properties: Investors can often reposition properties with minor cosmetic or leasing challenges for significant returns.

- Use Professional Underwriting: Don’t rely solely on pro forma numbers—get a full income/expense analysis with conservative projections.

Frequently Asked Questions

What is considered a good cap rate in Lake Havasu in 2025?

In 2025, cap rates between 6.5% and 8.5% are common for well-located commercial properties. Value-add assets may offer higher returns, but require deeper due diligence.

Which types of commercial properties offer the highest returns?

Industrial properties and multi-tenant retail centers offer some of the strongest returns this year. That is especially true in districts like the Industrial Park or the McCulloch Blvd corridor.

I’m an out-of-state investor—can I invest remotely in Lake Havasu commercial property?

Yes. Randy Shuffler offers full support for remote buyers, including virtual tours, transaction coordination, and personalized property vetting for ROI potential.

Ready to Invest in Lake Havasu? Let’s Talk.

If you’re looking to invest in commercial property with solid cap rates and long-term growth, Lake Havasu should be on your shortlist. Whether you’re local or investing from out of state, I’ll guide you through the market. I can help you identify the right properties, negotiate contracts and develop a strategy.

Let’s find the right deal for your portfolio. Contact us to schedule your free investment consultation now.