Why Cost Segregation Boosts Commercial Cash Flow

Cost segregation is a smart way to boost commercial cash flow. It helps property owners recover costs more quickly and retain more income.

The process separates building components into categories that depreciate at different rates. That allows you to claim larger tax deductions earlier. The result is more money available for repairs, upgrades, or new investments.

For commercial investors, better cash flow means stronger growth. Cost segregation helps you achieve that by reducing taxable income without changing your operations. It’s a legal, IRS-recognized approach that many property owners now use to increase their returns.

Let’s look at how cost segregation works and why it’s an essential strategy for commercial investors today.

How Cost Segregation Works

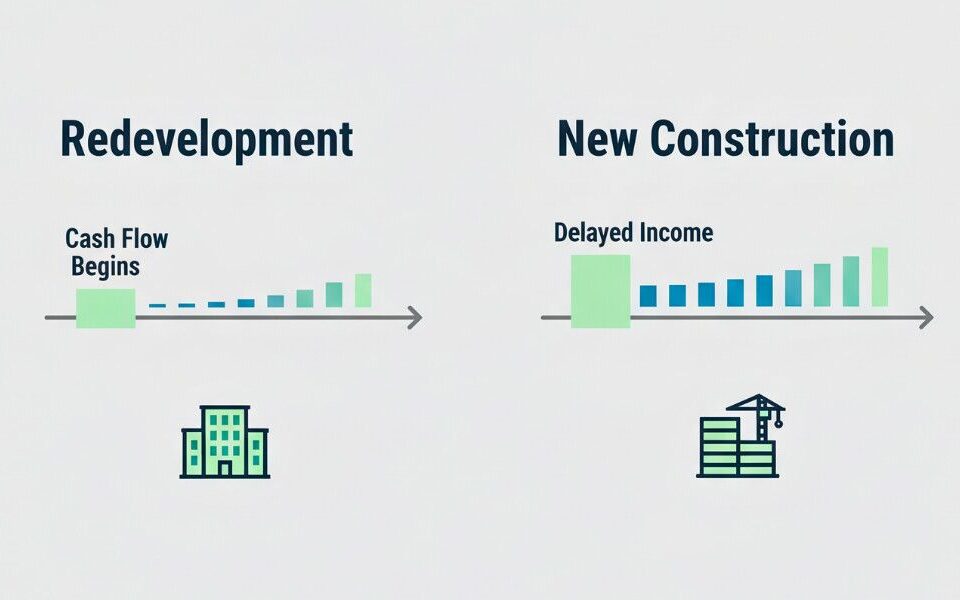

When you buy or improve a commercial property, you can depreciate its value, usually over 39 years. Cost segregation helps you accelerate depreciation for assets that wear out faster. Common examples include fixtures, flooring, lighting, and landscaping, which may depreciate over 5 to 15 years.

Claiming these deductions earlier lowers your tax bill and improves cash flow. A professional cost segregation study conducted by engineers and tax experts identifies qualifying items. That is necessary to ensure compliance with tax rules and maximize savings.

Why Investors Choose Cost Segregation

More Cash Flow Right Away

Accelerated depreciation means lower taxes in the early years of ownership. The savings increase your available cash for business growth.

Better Overall Returns

You can use your tax savings to buy new properties or make upgrades. That will help improve your returns on investment in both the short term and long term.

Works for Most Property Types

Cost segregation applies to offices, retail centers, multifamily buildings, and warehouses. Almost any income-producing property can qualify.

Detailed Asset Records

The study reveals the materials used in your property, aiding future repair planning and cost savings.

The Best Time to Start a Cost Segregation Study

The best time to do a cost segregation study is right after you buy, build, or renovate a property. That helps you get tax deductions sooner.

You can also qualify for a study on older properties. A retroactive study can help you recover missed deductions from previous years, giving you extra cash for new projects.

If you plan a major remodel or a new purchase, make sure to include cost segregation in your financial planning. It’s a quick way to improve your cash flow.

Common Myths About Cost Segregation

The following are common misconceptions about cost segregation:

- It’s only for large investors. Even smaller property owners can see significant benefits. Many studies start at properties valued around $500,000.

- It triggers audits. When appropriately documented by professionals, it meets IRS standards. Cost segregation often strengthens audit protection.

- It only applies to new buildings. Existing buildings qualify too. Retroactive studies can unlock savings for older investments.

For more on qualified property types, check the IRS Audit Technique Guide on Cost Segregation.

How Cost Segregation Builds Long-Term Value

Cost segregation saves you money over time. You can use early tax savings to reduce debt, make upgrades, or buy new properties. It turns depreciation into cash for your investments, helping you stay competitive.

FAQs About Cost Segregation

What is cost segregation in real estate?

It’s a method that separates building components for faster depreciation and bigger early tax deductions.

Who benefits most from cost segregation?

Commercial property owners, investors, and developers who are looking to improve cash flow and reduce taxes.

When should I request a cost segregation study?

Soon after buying or renovating a property. You can also use cost segregation on older properties.

Who performs a study?

Certified engineers and tax professionals with experience in property depreciation and asset classification

Start Improving Your Cash Flow Today

Cost segregation helps you keep more of the property’s income. By working with a local expert, you can find savings and boost your portfolio’s performance.

Contact Randy Shuffler to see how cost segregation and market insights can improve your cash flow strategy.