Why Redevelopment Beats Ground-Up Construction in Lake Havasu Right Now

In Lake Havasu, the fastest way to kill returns is not bad pricing. It is lost time.

Investors often focus on basis, rent, and exit. All of those matter, but in this market, the clock quietly determines whether a deal is financially viable.

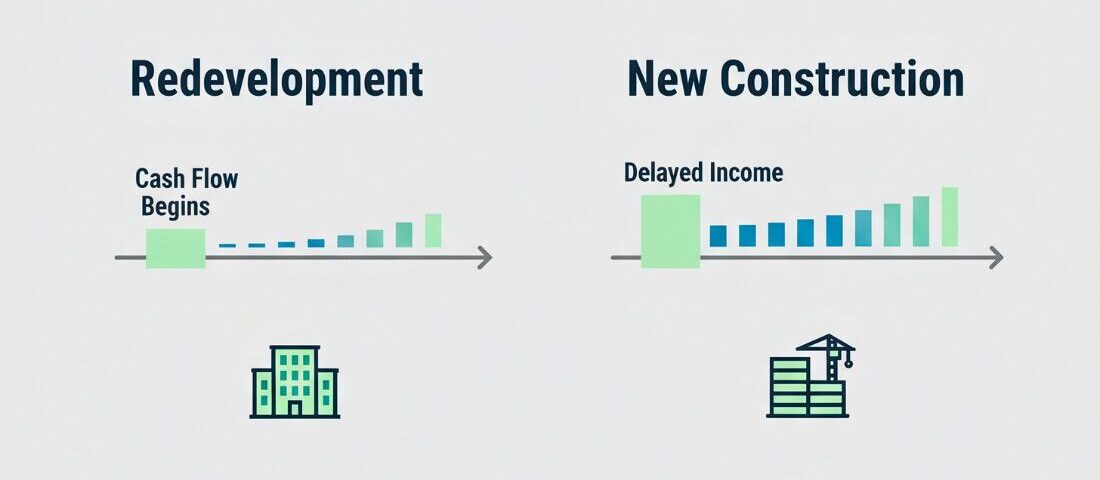

That is why disciplined capital flows into redevelopment over ground-up construction. New builds can succeed, but speed-to-income drives results in a constrained market.

On the ground, the advantage of redevelopment is clear.

The Misleading Math Behind Ground-Up Projects

On paper, buying land and planning ground-up construction looks like the cleaner path to upside. You get brand-new buildings, modern layouts, and top-of-market rents. The underwriting models look sharp, and the pro formas appear safe.

Spreadsheets often ignore friction, and Lake Havasu has plenty of it. The market is not land-rich or plug-and-play. Inventory is tight, and development rarely moves in a straight line.

Every step adds delay, cost, or both. Stretch the timeline, and you stretch the risk. Even strong, well-planned projects can lose their edge before they ever produce income.

The Reality of Ground-Up Construction Near Lake Havasu

Ground-up deals in Lake Havasu stall in the same spots repeatedly. Buildable land is scarce and often comes with topography challenges. Wash and floodplain engineering can add months before a shovel hits the dirt.

Grading, fill, and retaining walls are significant line items. Utility coordination takes longer than expected, and entitlement and inspection sequencing rarely move as fast as the schedule assumes.

Stack all these factors together, and a ground-up project can take 1-5 years to reach stabilized income. During that time, capital sits idle, construction costs climb, interest rates shift, and rent assumptions change. By the time income arrives, the deal you underwrote may no longer exist.

That risk is real, and it compounds quietly while you wait to get paid.

Why Redevelopment Wins Today

Redevelopment avoids the friction that bogs down ground-up construction. The project isn’t starting from zero. You’re buying existing entitlements, connected utilities, and immediate or near-term income. That compresses the exposure window.

We often see remodels or repositioning projects hitting accurate net returns of 7-8 percent. Meanwhile, a similar new build barely justifies 3–4 percent once you factor in timelines and risks.

New construction is not inherently bad, but time-to-income is costly in Lake Havasu. By focusing on value rather than chasing headline rents, a redevelopment strategy can protect downside more effectively.

The Hidden Risk That Kills Returns

When a market is land-rich, waiting is an inconvenience. If the market is land-constrained, waiting becomes a risk.

Every additional month before stabilization increases exposure to cost overruns, rent softening, lending changes, and utility or allocation surprises. None of these events is dramatic on its own. They are small shifts that compound over time.

Redevelopment compresses that risk. Ground-up construction magnifies it. That’s why selective capital here favors deals that generate income sooner, even when the upside looks smaller on paper. Certainty often beats ambition when inventory is tight.

How Redevelopment Wins

A buyer recently evaluated two opportunities side-by-side. One was a ground-up project with strong projected rents and a clean design. The other was an older property that needed work. Nothing dramatic: deferred maintenance, dated units, under-managed income.

At first glance, the new build penciled out. After we walked through the real timeline, stabilization would take nearly four years, assuming no significant surprises. Interest carry began eroding returns early. By the time the project reached actual net income, the yield had compressed sharply.

The redevelopment deal told a different story. Income started immediately. Renovations rolled out in phases without shutting down operations. Rents moved up steadily rather than all at once. Within 18 months, the deal stabilized at an accurate net return well above what the new build could justify.

Nothing heroic happened. There was no market spike or aggressive rent push. It was the shorter exposure to risk and faster access to income.

When timelines matter, boring execution often wins.

When New Construction Works

Ground-up construction is not dead in Lake Havasu. It simply operates in a much narrower lane.

It can work when land is already controlled near replacement cost and the use is hard to replicate. Success also requires an investor with patience and low leverage. These situations do exist, but they are the exception, not the rule.

Most buyers pursuing new construction are really seeking certainty. In this market, redevelopment often delivers more of it. That tradeoff is easy to miss and costly to ignore.

Local Realities That Shape Returns

Lake Havasu is not a market where deals simply appear. Inventory is tight, buildable sites are scarce, and timelines stretch. That reality drives returns more than cap rate assumptions ever will.

If you’re racing a 1031 clock or aiming to protect the downside, shortening the path to reliable income is critical. Right now, redevelopment aligns far better with that goal.

Answers to Your Key Investment Questions

Is redevelopment always cheaper than new construction in Lake Havasu?

Not always on a per-unit basis. The advantage comes from time, not just cost. Getting income sooner often outweighs a higher upfront price.

Does redevelopment limit long-term upside?

Sometimes, but not as much as people think. Many redeveloped assets still capture rent growth while avoiding years of idle capital.

What about maintenance risk with older properties?

That risk is real, but it is visible and underwritable. Construction delays and entitlement risk are harder to control once you are in the deal.

How does financing compare between the two strategies?

Redevelopment often qualifies for more flexible financing earlier because income already exists. That reduces carry risk.

Is this specific to Lake Havasu or true elsewhere?

The principle applies everywhere, but it matters more in land-constrained markets like this one.

Are there cases where waiting is worth it?

Yes, but only when you can protect the downside and factor in patience honestly.

Take the Fast Track to Profitable Deals

In Lake Havasu, building the newest thing does not always create value. Shortening the path to a durable income is often the better option. That is why redevelopment keeps winning the math right now.

At Shuffler Commercial Realty, we make it simple to see the numbers. For a quick, no-pressure look, send us the address. We’ll run a true-net snapshot and let you know whether it pencils.

Talk with my team today and see how quickly your Lake Havasu investment can start delivering real returns.