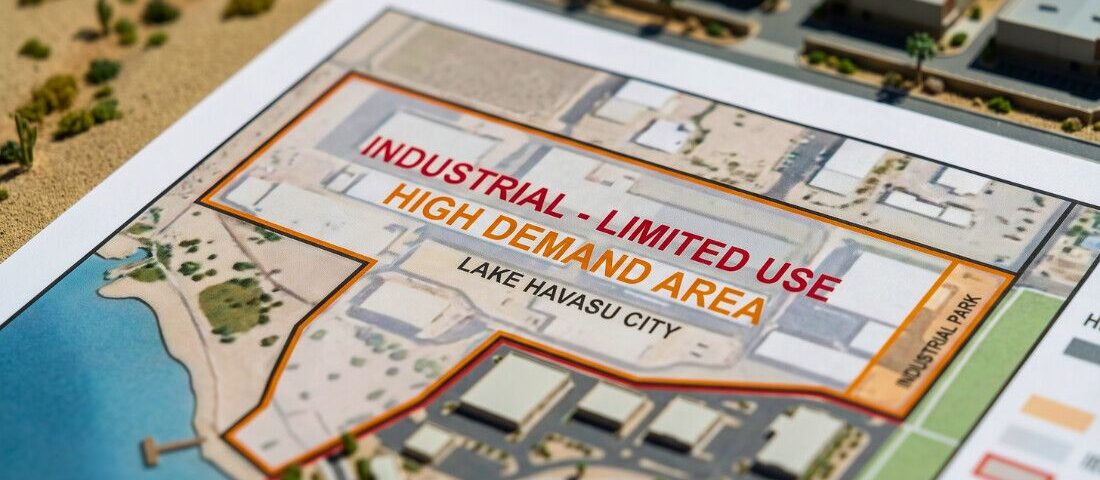

What Makes the Market for Lake Havasu Light Industrial So Tight?

To understand where pricing power truly sits in Lake Havasu commercial real estate, ignore the headlines. Pay attention to zoning instead.

Light industrial land currently faces the tightest constraints of any commercial asset in the city. That scarcity isn’t theoretical. It drives pricing, accelerates deal velocity, and leaves little room for error in underwriting.

The situation is not a hype cycle. It’s a supply problem behaving exactly as supply problems do.

Here’s how that scarcity plays out in the market.

Why Zoning Matters More Than Market Noise

Many outside investors treat Lake Havasu too broadly: industrial is industrial, demand is demand, and growth is growth.

That logic falls apart here. Zoning does not treat all industrial uses as interchangeable. Light industrial zoning has become a bottleneck because too many different businesses must compete for the same limited properties.

Pricing power follows zoning constraints, not investor sentiment. Overlooking zoning details can lead to paying for upside that no longer exists.

Debunking the Myth: “Industrial Is Industrial”

There are many types of industrial properties in Lake Havasu. Out-of-area buyers often group these uses:

- Warehouses

- Flex buildings

- Storage facilities

- Contractor yards

On paper, they may seem similar. Locally, they are not. In Lake Havasu, many of these uses funnel into the same zoning category. Light industrial absorbs demand that would usually spread across heavier or more flexible industrial corridors in other markets.

How Zoning Reshaped the Market

Lake Havasu has very little heavy industrial zoning. The city also lacks expandable industrial corridors to absorb new demand as prices rise. At the same time, the city restricts specific uses, most notably storage facilities, to light industrial zoning only.

That changes how the market operates. It concentrates demand into a narrow slice of the city. As a result, the pricing floor is higher. It also limits the options of users who would typically have zoning alternatives.

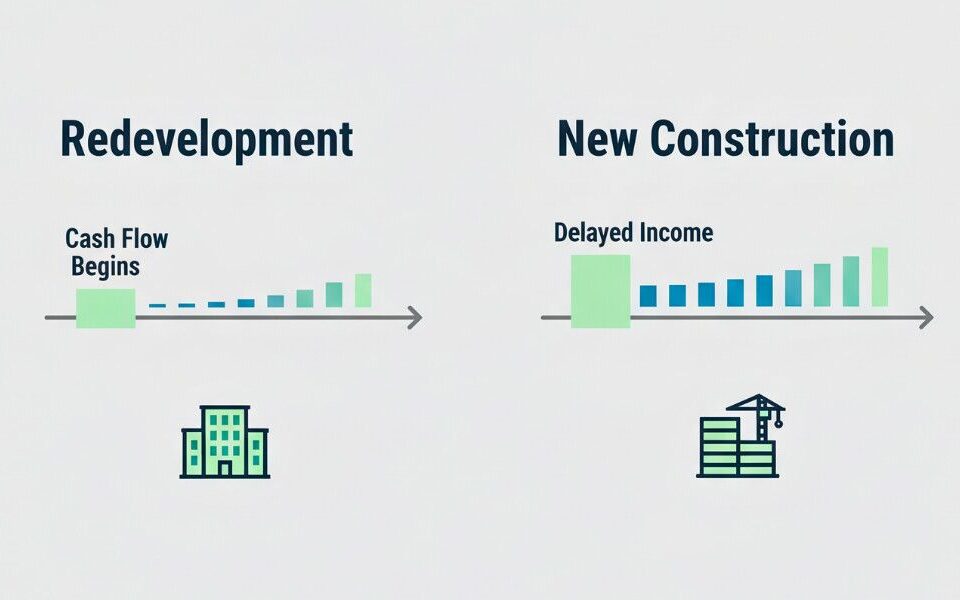

Why Supply Can’t Catch Up

In most markets, rising prices attract new supply. That release valve doesn’t work well in Lake Havasu. Industrial parcels are already scarce, and the city is geographically boxed in. Entitlements and infrastructure move slowly.

You cannot simply rezone your way out of this overnight. Even when demand spikes, supply responds slowly and unevenly. That is why light industrial land appreciates differently from lower-intensity commercial zones.

Timing matters more than optimism. Waiting for relief that may never come is not a strategy.

A Real-World Underwriting Moment

We recently walked a light industrial deal that looked bulletproof at first glance. It had tight zoning, strong rent, and a clean story.

Then we examined the income. The tenant was there by default, not necessity. Replacement costs were rising, but rents were already near the ceiling for that use. Even a slight softening in storage demand would quickly thin the exit math.

Local context determines the downside. Scarcity creates value only when income proves durable.

What Light Industrial Does Well

Light industrial assets offer clear advantages:

- Durable baseline demand

- Limited zoning alternatives for tenants

- High barriers to entry for new supply

These factors support long-term value, but they do not guarantee returns. Zoning provides a tailwind, not a substitute for careful underwriting.

The Real Risk Investors Miss

Many investors confuse scarcity with safety, but the two are not the same.

In Lake Havasu, the primary risk is not zoning. The risk comes from overpaying for future demand that pricing already reflects. Once scarcity becomes obvious, it quickly moves into prices.

That is why discipline matters more in tight markets, not less.

How We Back Into Value

When we underwrite light industrial properties in Lake Havasu, we start with blunt questions:

- Does the tenant truly need an industrial site, or does it operate there only because no alternatives exist?

- What happens if storage demand cools or shifts?

- Does today’s rent reflect replacement cost, or does scarcity drive it?

Scarcity can support value for a long time, but it cannot rescue a deal when income fails.

A Market Defined by Constraint

Lake Havasu is not a market where inventory simply appears. Commercial supply is tight. Industrial land is tighter. Light industrial real estate sits at the narrowest point of all.

That reality does not justify rushed deal chasing. It demands discipline. The correct response is to slow down, verify the income, and protect the downside before leaning into the upside.

The Bottom Line for Investors

Light industrial zoning in Lake Havasu is tight for a reason. The constraint is real, durable, and measurable. Zoning alone does not make a deal succeed. Income durability does.

To move decisively without panic-buying, you need local knowledge. It ensures timing and pricing stay aligned with reality.

Common Questions Investors Ask

Why has light industrial outperformed other commercial land?

Because demand flows into it while supply remains capped. That leaves multiple uses competing for the same zoning. Outperformance has a structural driver.

Is all light industrial land equally valuable?

No. Access, parcel size, utility capacity, and allowed uses matter. Some sites trade on scarcity alone. Others trade on actual utility. Zoning is the starting point, not the finish line.

Does storage demand drive most of the pricing pressure?

Storage plays a significant role, but it is not the only driver. Contractor, service, and flex users all compete here. Reliance on a single demand driver increases risk.

Can zoning change and release supply?

It can, but not quickly. Political process, infrastructure limits, and geography slow it down. Betting on near-term rezoning is usually speculation.

Are prices already too high?

Some are. Others still pencil with disciplined underwriting. Deal selection matters more than market timing.

Is light industrial safer than other commercial assets?

It has more substantial barriers, but safety still comes from income durability. Scarcity reduces competition, not risk.

Confirm the Numbers Before You Commit

Before making a deal for light industrial property in Lake Havasu, make sure the income stream is truly viable. Don’t rely on scarcity alone.

Shuffler Commercial Realty helps you separate what is real from what does not pencil out. Contact my team today for a clear assessment of your potential investment.